Is the market bull-run over?

Dear Investor,

The financial landscape of India is ever-changing. And as financial literacy increases, people are making the most out of their money through various investment avenues. Especially the more tech-savvy, younger working professionals, are very well-versed with newer financial instruments.

While that’s definitely a good thing, it often leads to certain biases, which should be avoided. Naturally, we’re talking about optimizing asset allocation, and therefore, diversification.

“What is asset allocation?”

In simple terms, asset allocation is how you distribute your investments into different avenues. Your asset allocation reflects how much risk you are willing to take on for potentially higher returns, and how much of your investment corpus you are unwilling to risk at all. And we’ve all heard about the importance of diversification. At it’s core, diversification is spreading your risk to ensure sudden unexpected events don’t cost you too much.

“All of this is fairly obvious. What’s the point of you repeating it?”

Well, if you are a disciplined investor religiously following your preferred asset allocation strategy, that’s great. Today’s article is for the folks who don’t come in that category.

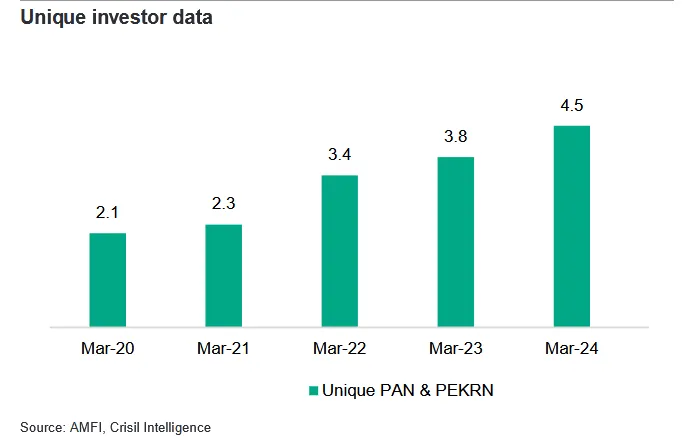

You may be surprised to learn just how many people would belong in the latter category. In the past 5 years, the number of unique mutual fund investors has more than doubled, from 2.1 Cr to 4.5 Cr!

This is a classic example of people following short-term trends without considering their investment strategy. Just because something has performed well in the past doesn’t mean it will continue to do so.

A healthy investment portfolio contains a balance of fixed-return products alongside riskier products. And even in the worst of market conditions, fixed-return products maintain an unshakeable foundation of a safe investment portfolio.

Investors in crores (As per AMFI records)

“What should I do?”

There are many investment strategies out there, depending on your risk appetite. General practice involves decreasing your exposure to riskier assets as you grow older, but depending on your goals, you could follow a different strategy.

We’re not here to tell you how to distribute your portfolio, just that you should make a plan and stick to it.

We’ll be sure to keep you informed with such deep dives into the financial system.

Until next time, have fun Super Investing!

Disclaimer: This content is meant purely for educational purposes and is not to be taken as an investment advisory.