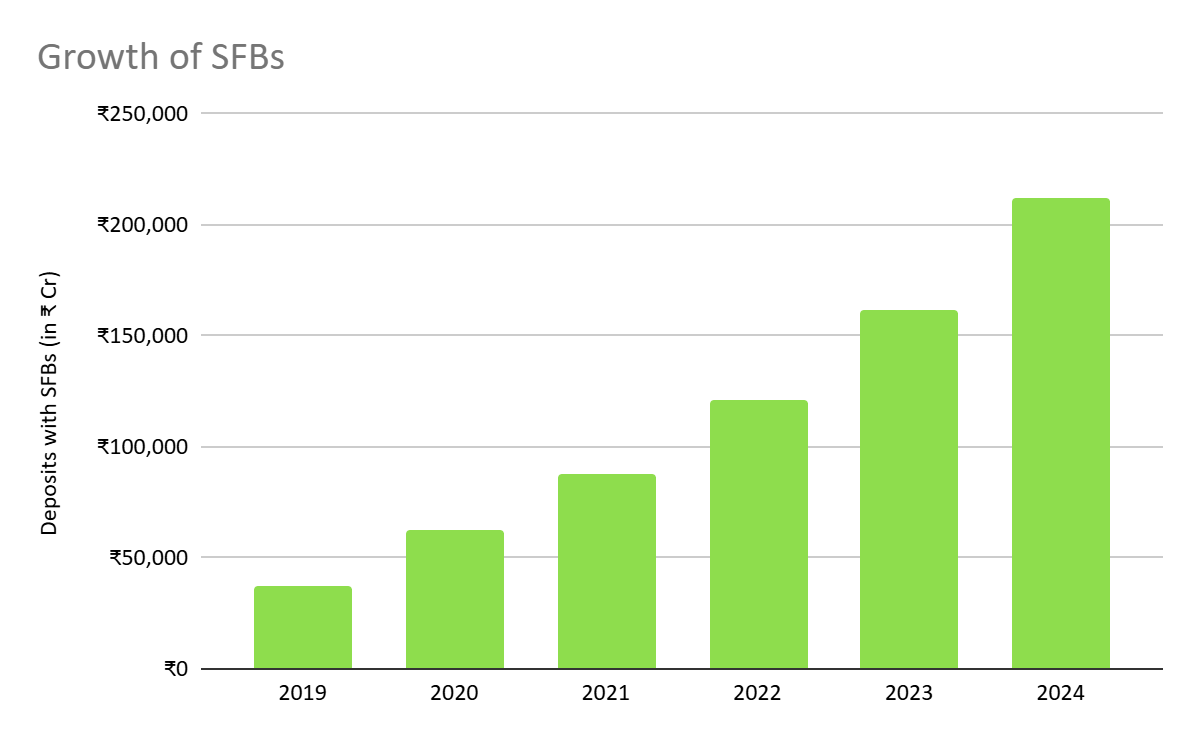

Small Finance Banks are on the rise!

Dear Investor,

As we hope you have noticed, the Fixed Deposit market in India has been changing recently. Like all other financial products, FDs are now competing for an increasing share of investors’ portfolios. You may have even come across banks offering FDs at rates as high as

9.5% p.a.

To top it off, these FDs areinsured up to ₹5,00,000

by the DICGC, a subsidiary of the RBI!It sounds too good to be true, doesn’t it? Well, it isn’t.

Today, we’ll be looking into

how

banks, at least Small Finance Banks (SFBs) in particular, are able to offer such high rates, andwhy

they do so.(Data as per RBI records)

At the end of the day, all banks are businesses, and work to maximise profits. So why and how do SFBs offer rates that are so much higher than traditional banks?

“Why do SFBs offer rates so much higher than bigger banks?”

The primary factor to understand here is that banks tend to maintain incredibly high customer loyalty. While this is a mostly function of trust, the complicated process of opening an account with a different bank makes it very rare for customers to change their banking provider. This is very important.

Secondly, just like any other business, banks are always looking to increase their revenue. And for a bank, revenue is a function of their Assets Under Management (AUM), which is just a technical term for the value of the cash deposits they hold.

With this context, it’s easier to understand why SFBs offer higher rates.

In a market that’s historically been first-come-first-serve for a bank, the only way for smaller players to get any customers is to offer a better product. In this case, a better product means higher returns on deposits.

And given how much effort is involved in changing banks, the returns need to be significantly higher, which means offering 9% p.a. returns where your traditional banks are offering 7% p.a. on average.

“Okay, I see why they would need to offer such high rates, but how can they afford it?”

To understand this, we’ll take a small peek at how a bank makes money. The primary source of a bank’s income is interest earned on various loans, investments. This makes up about 85% of their income on average. The remaining 15% comes from brokerage, commissions, exchanges, etc. But we’ll be focusing on the 85%.

Their expenses include interest paid, and operating expenses (the usual costs of running a company, including salaries, rent, etc.)

This is how much profit banks made last year. And what the profits look like as a fraction of the net interest income.

(As per RBI records, for 12 Public Sector, 21 Private Sector and 12 Small Finance Banks)

The reason SFBs can offer such high rates is that they are willing to reduce their profit margins in order to expand their user base.

So while nearly every Scheduled Commercial Bank can offer higher rates, only SFBs do, because they are the only ones who need to.

As we’ve seen today, the banking system has been in dire need of some healthy competition, which SFBs are now offering. Hopefully, the trend continues, and the banking system upgrades to keep up!

We’ll be sure to keep you informed with such deep dives into the financial system.

Until next time, have fun Super Investing!

You can easily book top FDs with Small Finance Banks on our platform.

Disclaimer: This content is meant purely for educational purposes and is not to be taken as an investment advisory.